Case Studies: Metro do Porto S.A., Portugal

| Metro do Porto S.A., Portugal | |

|---|---|

| Project Type: | Greenfield |

| Type of Project Financing: | Private (Co) Financed Transport Infrastructure |

| Contract duration: | 50 years |

| Budget: |

Investments 1st Phase (1993-2005): Expected: €1.070.852.000 |

| Project Time Line | |

| 1993: | Creation of the Oporto Metropolitan Metro Company (Grande Área Metropolitana do Porto, Anonymous Society) (S.A.) - Public Company responsible for planning, promoting and managing the bidding process for the concession of the infrastructure and service provision- € 997.595,79 |

| 1998: | Concession phase: 50 years concession awarded to Metro do Porto, S.A. |

| 1998: | 1st Construction Phase: The provision of the infrastructure, rolling stock and other systems is subcontracted by the Metro do Porto, S.A. to NORMETRO Group of Complementary Companies. |

| 2003: | Operating Phase: The metro service is inaugurated serving the section between Trindade and Senhor de Matosinhos. |

| 2010: | The operation of the metro service is awarded to the consortium of private companies ViaPorto. |

Contents

Introduction

Metro do Porto is the metro network of the city of Porto in Portugal. The metro is operational since 2002, with lines added in 2004, 2005, 2006, and 2011. The Metro do Porto network is composed by 5 lines serving the Oporto Metropolitan Area. Apart from the metro service, Metro do Porto S.A is also responsible for the operation and maintenance of the Guindais funicular system.

The Metro do Porto project started in the 90’s with great support from the municipalities of the Oporto metropolitan area. In 1993, the Portuguese national government created the Oporto Metropolitan Metro Company (Grande Área Metropolitana do Porto, Anonymous Society S.A.), a public Company responsible for planning, promoting and managing the bidding process for the concession of the infrastructure and service provision. In the 90’s , Oporto Metropolitan Metro Company discussed and organized the concession process, which resulted in awarding the concession of the operation and construction of the service to the Metro do Porto, S.A. for 50 years.

Also in 1998, Metro do Porto S.A. subcontracted the concession services to the Normetro group of complementary companies. This consortium has been responsible for designing, building, operating and maintaining the metro services in the first phase (2010). In 2010, Normetro’s concession was replaced with a 5-year concession for the operation and maintenance of the metro network to the private consortium Via Porto.

Up to 2008, 24% of the project’s budget was paid for by public money (public budget transfers, European funds, additional payments from shareholders, and compensations paid by the State for financial rebalancing), 67.5% was paid for by loans (80% of which had government guarantees), and the rest was financed through leasing. User charges have been collected since 2003 through an intermodal ticketing company which shares revenues between the participating operators in the region. The system is integrated with the other transport modes in the Oporto Metropolitan Area. TIP, g.c.c. (Intermodal Transport of Porto) is a group of complementary companies responsible for managing the integration within all public transport services inside the Oporto Metropolitan Area.

The Contracting Authority (Public Party)

Since the first years of the Metro do Porto project, the development has been driven by the municipalities of the Oporto Metropolitan Area. Considering the role of this political will in the construction, the conceptual role of the contractual authority may be extended to a contracting authority organized in a two level structure.

On the national level, the Portuguese Ministry of Public Works, Transportation and Communications (Ministério das Obras Públicas, Transportes e Comunicações) is considered the official project grantor. However, different to traditional public private concessions, Metro do Porto has been granted to a consortium of public entities (Municipalities, Portuguese National Government and two public transportation companies).

After this process, Metro do Porto S.A. have contracted a consortium of private companies named Normetro. On this second level, Normetro was responsible for the design, construction, finance and initial operation of the metro system.

The Concessioner (Private Party)

Regarding the complex contracting structure described in the previous section, this section presents the SPVs with their respective capital shares.

- Metro do Porto, LP

1 – Foundation: 1993 (€ 5.000 Share capital) a) Municipalities of Porto Metropolitan Area = 60%; b) Sociedade de Transportes Colectivos do Porto, SA (STCP) – Public Transport Society of Porto = 25%; c) Portuguese Government = 10%; d) Comboios de Portugal (CP) – Portuguese National Railway Company = 5%.

2 – 2008 (€ 7.500 Share capital) a) Portuguese Government = 40%; b) Municipalities of Porto Metropolitan Area = 40%; c)Sociedade de Transportes Colectivos do Porto, SA (STCP) – Public Transport Society of Porto = 16,67%; d) Comboios de Portugal (CP) – Portuguese National Railway Company = 3,33%.

- Normetro, Group of Complementary Companies (€ 27.477.746,32 Share capital): Responsible for the Infrastructure Construction and Rolling stock Acquisition

a) BSN – Santander Bank for Portuguese Business, SA (18,82%) b) Santander Totta Bank (81,17%) c ) Metro do Porto Consultoria, LP (0,001%)

- Transdev Transports, LP (Initially was part of the Normetro group): Responsible for the operation of the system and human resources management

- Transpublicidade, S.A. (€ 99.759,58 Social Capital): Responsible for manage the advertising facilities inside the infrastructure

a) Metro Consultoria, LP (100%)

- TIP, ACE (€ 30.000): Responsible for operate the intermodal integration inside the Porto Metropolitan Area

a) Sociedade de Transportes Colectivos do Porto, SA (STCP) – Public Transport Society of Porto (33,33%) b) Comboios de Portugal – Portuguese National Railway Company c) Metro do Porto Consultoria, LP (33,33%)

Source:(Tribunal de Contas, 2006, 2010)

Sources of Financing

Until 2004, Metro do Porto has been financed by:

- Portuguese Government (National Investment and Expenditure Program): €99.898.296 (7,78%)

- European Investment Bank: €663.689.707 (51,47%)

- European Cohesion Funds: €265.989.296 (20,41%)

- Leasing: €249.999.999 (19,46%)

- Others: €5.000.000 (0,30%)

Users

Since 2013, Metro do Porto has a 66.6 kilometers network of 5 lines and 81 stations. In 2013, 55,931 passengers travelled in the Metro do Porto system.

Key Purpose for PPP Model Selection

In the first stage, the metro system has been granted to the consortium of public institutions due to the strength of the regional drivers of the project. The concession allowed the municipalities to assume the responsibility of pushing the development of the project plan and the concession process. The share structure in the SPV depicts this responsibility of the Municipalities of Porto Metropolitan Area and the support of the Portuguese Government.

After that, Metro do Porto only started to consider rendering the project a PPP one in 2003/04. For the second construction phase, the expansion plan expected to finance € 1.026 million by PPP contracts. At this moment, the PPP model has been selected oriented to relief the finance burden of the project.

Project Timing

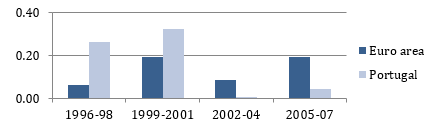

In the 90’s, Portugal experienced a great investment momentum for infrastructure projects.

Figure 1 - Triennial Gross Fixed Capital Formation growth rate (Portugal and EU)

Source: Composed by the authors based on the Eurostat database

During those years, the Portuguese economy experienced gross fixed capital formation rates almost 3 times higher than the European average (Figure 1). In addition, several infrastructure projects were contracted in Portugal and other European countries. Supported by the EU finance policy, those projects have been partially financed by the European finance vehicles in order to reduce the economic gap between those countries and central Europe (Larre & Torres, 1991).

The initial investments in the Metro do Porto network have been supported by this macroeconomic environment. The participation of the European Investment Bank (51.47%) and European Cohesion Funds (20.41%) in the project finance structure depicts this supranational support. Most of the investments supported by those funds have been co-financed and awarded in public private partnership contracts.

Project Locality and Market Geography

The Metro do Porto represents the most important transport axis in the Oporto Metropolitan Area. Composed by 17 municipalities, AMP is the second metropolitan area of Portugal, with a population of 3.7 million inhabitants, and an increasing population density of about 1580 inhabitants per square km. Historically, the political and economic strength of the Oporto Metropolitan Area may be considered one of the most important drivers of the project.

Procurement& Contractual Structure

Tendering

In 1998, “Metro da Grande Área Metropolitana do Porto”, a Public company founded in 1993 to plan and manage construction of the Metro do Porto, became an anonymous society company (Metro do Porto, S.A.) and was granted with the concession rights to construct, operate and maintain the Metro system. In the same year, Metro do Porto, S.A., exclusively owned by public stakeholders (Municipalities, Public Companies and National Government), subcontracted the construction of the infrastructure, systems and acquisition of the rolling stock to a Group of Complementary Companies named Normetro.

Contract Structure

Apart from the metro service, Metro do Porto S.A is also responsible for the operation and maintenance of the Guindais funicular system. Outside the transportation supply chain, Metro do Porto is also responsible for the advertising and intermodal integration management of the metro system. TIP, g.c.c. (Intermodal Transport of Porto) is a group of complementary companies responsible for managing the integration within all public transport services inside the Oporto Metropolitan Area.

Initially, the project was designed to be mainly funded by user fares. The pricing system is calculated in accordance with the travelled distances within the displacement zones. The fare system also includes a social pass, a daily pass and discounts for elderly users and children. In the cases of operational debts, the project also considered the payment of public subventions from the national government. Since 2004, the Portuguese government has been paying financial compensations to cover part of the operational deficits of the Metro do Porto Service (64.700.000 EUR between 2003 and 2008).

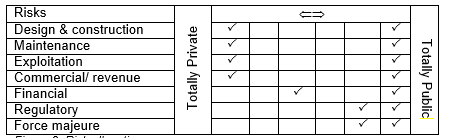

Risk Allocation

In the Metro do Porto concession, it is a hard task to define the risk allocation between public and private parties, since the concession has been awarded to a public company. Since 1998, all shareholders of the Metro do Porto, S.A. are public authorities and other public companies. Historically, this position in the middle between a public or a private entity has defined quite an ambiguous risk allocation structure.

All Design, Construction, Maintenance and Revenue risks are the responsibility of the Metro do Porto, S.A. In 1998, the SPV subcontracted Normetro, G.C.C. to provide those services and operate the system. The sub-concession contract does not transfer any of those risks to the Normetro consortium. However, according to certain contractual guarantees, the public party is the ultimate responsible for rescuing, ending or recovering the concession in cases of poor financial performance in two consecutive years. The risk allocation is depicted in Figure 2.

Performance

In the Metro do Porto concession contract, performance has been defined in a two dimensional evaluation process based on financial and operational perspectives. Not much is discussed about operational elements for performance control, but the contract focuses on safety elements that must be provided jointly with the local police and insurance companies.

On the financial perspective, the concessioner is expected to invest and operate the system with financial strength. The concession contract stipulates that the concessioner will be forced to subcontract the metro service exploitation if the concession presents negative annual results for two consecutive years.

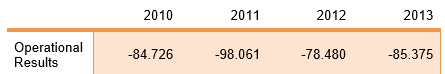

In numbers, the Metro do Porto system has been improving the accessibility in the Porto Metropolitan area. For instance, the system ridership grew from 5.96 million users in 2003 to 51.5 million in 2008. Nevertheless, in the same period, the operational revenues only grew from 37 million to 53 million. Table 1 presents the operational performance of the Metro do Porto concession. The negative results have been supported by financial compensation from the public authorities.

Table 1- Operational results 2010-13

(Porto, 2013)

Project Outcomes

Although the Metro do Porto project has been observed as a success case of PPP agreements for the provision of transportation service, recently, this investment has been suffering from financial problems. Since 2003, the Metro do Porto system has been losing profitability and financial and organisational autonomy due to the debt structure (cost of the debt services and lack of repayment capacity).

References

- Larre, B., & Torres, R. (1991). Is convergence a spontaneous process? the experience of Spai, Portugal and Greece. OECD Economic Studies, Spring(No. 16), 169–198.

- Metro do Porto (2013). Metro do Porto - Relatório e contas de 2013.

- Tribunal de Contas. (2006). RELATÓRIO de AUDITORIA No. 33/06 - Metro do Porto, SA, 97–98. Retrieved from http://www.tcontas.pt/pt/actos/rel_auditoria/2006/audit-dgtc-rel033-2006-2s.pdf

- Tribunal de Contas (2010). Auditoria ao Metro do Porto , SA Transportes Públicos Urbanos na Cidade do Porto.